Sunday, November 29, 2009

Weekend Long Term Perspective

Thursday, November 26, 2009

Wishing all a Happy Thanksgivings

Wednesday, November 25, 2009

Day-Trading Account Performance

Tuesday, November 24, 2009

Buy Limit FILLED at 1098.50 and 1096.50

Monday, November 23, 2009

The Scenario Becomes Reality

Another Low Risk Trade Executed from Sunday night

Like many other traders ( most of them simulating ) in $ES_F StockTwits my trades have been posted after the fact but with the Live Performance Record also posted in Twitter.However since 95% of other traders in ST are not live trading and do not know how to trade I have desided not to share my trade entries again in that medium.

Detailed Profile Compliments of My Secretary at Large

Profile for Monday 11-23

Sunday, November 22, 2009

60min - View of the Trend and Projections

Saturday, November 21, 2009

Opt.Exp Friday Price Action Review

Review Complements of Twitter

Friday, November 20, 2009

Day 2 of Market Timing Strategy

Recent Data:

Thursday, November 19, 2009

SHORT Position closed and reached Target as expected

Final target filled at 1087.50 for a gain of + 21 pts profits. The low was 1086.50.The short position was posted at 10pm on Wednesday evening.

The previous volume profile chart " Targets Above Monday's High" posted by my Secretary on Tuesday at 2:50am was for Wednesday's trading session and some idiots in Twitter/StockTwits made comments suggesting that my SHORT position on Thursday was a result of that previous chart which only showed price levels and NO projected market direction.That only shows the low level of IQ and stupidity of some people in $ES_F StockTwits.

Wednesday, November 18, 2009

Low Risk SELL Setup

Review for Tuesday Nov 17

Tuesday, November 17, 2009

I-love-to-throw-counterfeit-money-from-my-helicopter

Monday-November-16-Retail Sales

Review of price action on this Retail Sales Day with after market follow through and some easy notes....

Another Useful Study for Day-Trading

It helps when you have a hard working Secretary doing the research. lol

This is for the E-Mini S&P500 ( ES )

New Research/Study

Saturday, November 14, 2009

Review of Friday's Price Action

Wednesday, November 11, 2009

Reversal at Weekly Resistance

What do you expect, 1122 50% Weekly retracement on a Veterans Day with thin volume ? NO way !

I am been watching this so long that it becomes second nature.

Hey, I am trading this thing and posting this for others, so what do you expect...

Pre-Opening Game Plan

Breakout overnight from an NR24 on Veterans Day.

There is two ways to enter Long . Sometimes the price acton will reverse after the open at the BUY Zone or below it.

The Buy Rules : as long as price is not more than 2 points below the Green MA and there is a buy setup then the Long entry is executed.

If there is no buy setup then the Entry Trigger is at the break of the Green MA if the price is below it with a stop loss of only one point. In other words when price goes through the Green MA it will fill the BUY STOP Order and wil continue up without any retrace.

There is another factor to consider and that is the fact that this is trading very close to a Weekly Resistance at 1103 so the first exit should be at least at that level and the Daily RSI ( 2) is at 99

Monday, November 9, 2009

After the Open Review

Price action at the open came very close to touching the Green MA and a Vertical steep climb followed. Only one opportunity to enter Long as the market never got close to the RED MA

There was one famous character in Twitter that sold 1085 at 1:23pm ( BAD Entry ! ) against the Trend and even added another at 1087 ! lol

Then he posted to his followers to "stay long" after he was stoped out for a loss ! what a ....

The break-out above Friday’s high began with a “gap” above Friday’s settlement. Acceleration in the direction of the “gap” was apparent at the open; with the potential of price re-test resistance at the overnight high.

After trading above 1080 during the first hour of the session [A-B period] the price action took on the characteristic of a short covering rally, i.e. price continued to grind higher without a pull-back. The up move consisted of previous sellers being squeezed out of their prior positions. The lack of pull-back made for difficult intraday trading for many inexperienced and overconfident traders.

However, as today profile illustrates if you were set to buy the high or the MA and hold the positions for hours, there were occasionally opportunities where price did not auction back to its starting point and managed to grind higher.

The continued up-side movement, with slow momentum was fueled by a decline in the U.S. dollar, which lost ground against a basket of major currencies.Will not be surprise if the market gives back half of this rally tomorrow.

The characteristic short covering is further confirmed by the below average volume traded on the NYSE as 3,597 million shares were traded on the S&P 500 today. This volume output is 13% below the index's average daily volume generated over the past three months.

As there was no pull-back during the session, there is no strong indication of micro intraday support, i.e. initiated buying confirmed by responsive buying on the pull-back resulting in a higher high. Micro support during the session, if you’re willing to consider FLAT lining no action as support developed at 1082 / 1983.

In the absence of economic data and key earnings releases, market participants focused predominantly on the once again slumping US dollar and the stimulating effect its weakness continues to have on equity and commodity markets. The greenback pulled back significantly today based on news from the Group of 20 ('G-20') meeting. The G-20 have unanimously decided to continue the pattern of keeping stimulus measures in place and interest rates low. It was US Treasury Secretary Geithner's view that economic stimulus should remain in place for the time being; this drove the US Dollar Index back toward its 2009 lows.

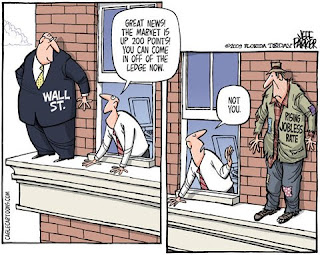

The strength that the equity market has shown over the past six sessions may be confounding for some investors, particularly the surge we have seen since last Friday's announcement that the US had now hit an unemployment rate of over 10%. Rather than being troubled by such data, it actually encouraged the recent, very strong rally on the major indexes. Some market observers claim however that this strong rise may in fact be at least in part 'artificial' ( i.e., not supported by the current economic fundamentals). The reason is that the decision to keep interest rates low around the world will ensure that a lot of 'cheap money' will continue to be pumped into the markets, boosting assets such as commodities, stocks, and currencies, particularly when the US dollar is falling. In fact, the US dollar is now being used as a carry trade vehicle.

Skeptics warn that the current rally has outrun the current improving economic fundamentals and that it could collapse once the US dollar recovers. One analyst spoke of the market rallying 'on fumes'. In a sense, the actual economic rebound taking place is being obscured by the 'artificial', dollar-driven rally in stocks and commodities.

In corporate news, Dow component Kraft was the only Dow stock that failed to rise today based on the news that its planned takeover of Cadbury Schweppes (for roughly 9.8 million British pounds) had failed. In earnings news, Electronic Arts announced a net loss of $391 million for its second fiscal quarter and said it would reduce its workforce by 17%. Adding further to the dire job loss picture, Sprint Nextel announced today it will axe 2000 to 2500 jobs in an effort to cut labor costs.

Here is a not so brilliant strategy that worked like a champ

As posted previously the ES did a breakout above Friday's High ( GAP +12Pts )

The odvious bullish reaction to the Unemployment Report was one clue.Many novice traders tend to fade the gap without been aware of the statistics of gaps been filled after the open.

There was no Long Entry Signal until 5mins after the 9:30am Open.

Here is another brilliant strategy

As promised here is another unique strategy by an " experienced " GURU:

Strategy: " SELL Against the strong

UP Trend , scaling in and place a stop loss of your own choosing " ( he never specified the proper risk level )

" The market is DEAD" posted the GURU in Twitter. lol

"Looks like $ES_F going for prior rejection at 1091-ish. Very steady uptrend no down rotations. Not normal/agreed" said another FAITHFUL follower, LOL

A classic case of The Blind Leading The Blind ! ....

Saturday, November 7, 2009

The Big Cash Pit Traded Index

Volume Moving Average has been decreasing divergent to the price peaks. The Blue MA is beginning to turn flat. If Long from below then it is wise to move a stop just below 1018.66

Another technical clue is everytime it has crossed the Red MA price has GAPed UP so next week it should do the same.

Here is the Recap of Friday

The Long Term View from a Day-Trading Perspective

Here is the Double Bottom and the reversal of trend. The reaction to the negative friday report is a clue that this market is going UP. Unless something extraordinary happens next week.

Final Review on Payrolls ( NFP ) Day

The Opening Range Breakout was a classic trade setup that has a fairly good probability of success and requires a stop of only one point ( low risk )and has a high reward if done properly at the open.

All positions were closed before the end of the session.

On Sunday Globex session I expect the low of this friday session NOT to be tested.

Continuation Of Review After The Open

Pre-Market Plan For Action and Review on NFP Day

Payrolls Report pushed prices down to the 60min Buy Zone below the VAL and the rest of the day was contained withing the range established by the Reaction to the Report.

There were many good setups but that is not the purpose of this illustration.

My Live Day Trading Performance is available for inspection in Twitter.

Another Wrong Projection

Thursday, November 5, 2009

Fed Day Recap

Tuesday, November 3, 2009

Review of Final Hours and Observations

Follow -Up and Execution

Execution of first trade is done as expected, then market pulls back to previous POC and consolidation takes place.

The next entry with the trend should be at the Buy Zone due to the fact that his is another consolidation ( Daily Doji ) session before the big event tomorrow: FED Day.

Pre-Market Plan For Action

Review Of Price Action

Monday, November 2, 2009

Market Action was both Humorous and Predictable

If there is no more downside follow through on Sunday night Globex session, then it will retrace back up to the 1048 to 1052 range.

Today that is exactly what transpired, the high was 1049.50, within the range predicted on Saturday.

But here is the funny part of the day.When the previous low was broken down, many traders and even " trading educators" were projecting more downside in Twitter.

But there was no catalyst or news to keep driving the market lower !, so I started laughing and at the same time restraining my urge to warn these other traders to exit their short positions or take profits.

Then the market started to reverse, or a normal pullback in a intraday downtrend, and I was reading so many Twitter postings of " sell it here" ! . I could not contain my laughter, it just was so funny!.

The market retraced back up more than 62%. I saw it coming and even took a long position which resulted in a handsome profit.

Early in the session, stocks rallied on a batch of positive economic news: The Institute for Supply Management announced that in October, US manufacturing activity had grown at the fastest pace since the spring of 2006, with the ISM Manufacturing Index coming in at a reading of 55.7. Also, according to the National Association of Realtors, pending home sales had increased in September for an eighth consecutive month, showing a monthly increase of 6.1%. Furthermore, in September construction spending was also up, rising 0.8% (thereby matching the gains seen in August). In all cases, results exceeded economists' expectations.

President Obama commented on the health of the US economy today, saying that the dire situation in the labor market would likely continue 'for weeks and months to come', underscoring that hiring is always a lagging indicator in a recovering economy. Obama added that 'We just are not where we need to be yet.... We've got a long way to go.' The next scheduled report on the employment picture is scheduled for this coming Friday; market observers believe it might show the US unemployment rate exceeding the 10%-mark.

There was also surprisingly optimistic news from the automotive sector, with Ford announcing it had earned close to $1 billion in the third quarter. Much of this success was achieved by extensive cost cuts, as well as by the success of the US government's Cash for Clunkers program, which delivered considerable rebates and thereby boosted sales.