Thursday, December 31, 2009

Short Swing Position now + 15.75 pts in profits

Wednesday, December 30, 2009

New Year 2010 the Year of the Tiger

On the last full trading session of the year, the S&P 500 and the Dow traded mostly in the red, but the indexes lifted in the afternoon and closed flat. Both indexes added a minute 0.02% for the session (for the week, the S&P 500 is currently up 0.73% while the Dow has gained 0.79%). Meanwhile, the NASDAQ 100 outperformed, climbing 0.35% today (the index is presently sporting a weekly gain of 2.13%).

Today's volume output on the S&P 500 was an anemic 1,780 million shares - 51% below the index's average daily volume production over the past three months.

The year's last full session brought little excitement and was again characterized by anemic volume (merely 650 million shares traded on the NYSE where the 50-day average is roughly 1.2 billion shares). The S&P 500 and the Dow spent most of the session mildly in the red but closed flat; the Nasdaq 100 was stronger, aided by strength in the semiconductor sector. A lack of leadership was again noted by the press.

The day's only notable economic data release pertained to the Chicago Purchasing Managers Index. According to the Institute for Supply Management, the latest ISM-Chicago data showed a pickup in production, new orders, and an improvement in the region's employment situation. The ISM-Chicago came in at a reading of 60.0 (beating economists' expectations), its best showing since 2006. The four-year high on the index shows that the US economy continues to recover, analysts commented.

Because of the dearth of noteworthy economic or corporate news releases, investors focused on the US dollar which ultimately gained 0.1% against a basket of major currencies.

Another sign that the fallout from the financial crisis is not over: The Treasury Department announced today that General Motors' former financing unit - GMAC Financial Services - will receive further government funding. $3.8 billion in cash will be pumped into GMAC to assist the company in dealing with its home mortgage business losses. Previously, GMAC had already received $12.5 billion in taxpayer money. The latest injection will boost the federal government's ownership stake in GMAC - from 35% to 56%.

Open Position: SHORT E-Mini S&P500 ( ES ) from 1126.

Tuesday, December 29, 2009

Short from 1126

Swing Position : SHORT

Now trading at 1119 + 7 points

SELL Signal worked like a champ, see previous post.

Although trading started on a bullish note today, a 'lack of leadership' was seen as the reason the indexes faltered later in the session. The rising US dollar (which gained 0.2% against a basket of key currencies) was also cited as a reason. The market was very quiet. For instance, the Dow's intraday range spanned a mere 36 points today, the narrowest range seen in almost three years!

The release of economic data appeared to have little impact on the direction of the major indexes today. On the housing front, October's data on the S&P/Case-Shiller Home Price Index came in close to consensus (actual value: 146.6; consensus estimate: 147.0). Meanwhile, the so-called Composite 20-City Home Price Index was down 7.3% in October (year-over-year), also close to the anticipated value (consensus: a 7.2% decline year-over-year). On a positive note, that value represented the slowest rate of decline seen in two years.

No surprises surfaced in regard to the latest reading on consumer confidence either. The index that tracks consumer confidence produced a reading of 52.9 (consensus estimate: 53.0). Although the current readings are well above their historic low of 25.3 seen in February 2009, consumer confidence values remain still well below levels that would signal a robust economy (a reading of 90 or higher would be required).

Friday, December 25, 2009

Breakout to New Highs

Noticed how often the market gaps opening higher , then does nothing all day . Also notice when the market closes that nearly 100% of the net gains had been put in... One wonders why the market opens at all some days.

Noticed how often the market gaps opening higher , then does nothing all day . Also notice when the market closes that nearly 100% of the net gains had been put in... One wonders why the market opens at all some days.100% of the markets recent gains have come from the overnight market (gap opens) and without them, the market would have been flat for three months.

The market has climbed steadily higher despite increasingly declining trading volume and consistent and material withdrawals from domestic equity mutual funds. Furthermore, if anyone was merely looking at the trading action in regular hours, one would think there was absolutely no profit made since early September.

The followers of this market will immediately realize what this implies: not only is there no volume breadth to the recent move in the markets, but the actual push higher likely occurs on at most tens of thousands of futures contracts on a daily/weekly basis. The fact that literally several blocks of AH trades, used persistently, can move the market higher by 6% over the past 3 months, even as regular trading accounts for absolutely no part of this move, and that the SEC finds nothing troubling about this phenomenon, should be sufficiently telling about how "efficient" US markets have become.

New home sales on Wednesday toppled like a drunk at an open bar ! New home sales crashed 11% in November to a 355,000 annual rate, which are 60,000 below low estimates! The hit includes downward revisions of 42,000 to the prior two months, which means the prior data were either put together by incompetent government boobs or were simply lies. No surprise there.

Tech issues outperformed again Thursday in a very slow session marked by anemic volume and decreasing volatility. Because of a lack of corporate news releases, investors focused largely on economic data releases.

The Labor Department reported a larger-than-expected decline in initial jobless claims (newly laid-off workers filing claims for unemployment). Compared to the previous week, these dropped from 480,000 to 450,000, better than the consensus estimate of 470,000. Although the labor market overall is still considered to be weak, today's data is encouraging as initial jobless claims are now at their lowest level since the fall of 2008. However, the impact of temporary holiday employment and low wages is hard to gauge and factor into seasonal adjustments. According to economists, initial claims numbers consistently below 425,000 (for at least several weeks) would be required in order to signal a stronger labor market (and an economy that is actually generating new jobs rather than just losing employment at a lesser rate). By the way most of those jobs been created are low wages or minimun wage, low skills, service jobs in Walmart, McDonals or Pizza delivery !

The Commerce Department reported that big-ticket durable goods orders to US factories were up 0.2% in November. While the overall increase was below economists'' expectations (for a 0.5% gain), orders were up 2% when transportation orders are excluded. Transportation suffered from a plunge in commercial aircraft orders and from slumping demand for motor vehicle parts. More orders however came from other sectors such as machinery, primary metals, as well as from computers and electronic products.

Two signs of more lingering after effects from the financial crisis / recession: In a rare Christmas Eve vote in the Senate, the US government debt ceiling has been raised by $290 billion to a total of $12.4 trillion. Further, the Treasury Department announced that it has removed a $400 billion financial cap on the money it is willing to lend to keep certain companies in business. Instead of capping the amount of funds it provides, the Treasury Department said it will start using a more flexible formula, basing the amount of support on how much a firm loses per quarter.

Beleaguered mortgage guarantors Fannie Mae and Freddie Mac (who purchase home loans from lenders and sell them to investors) are key beneficiaries of the changed procedures. Fannie Mae and Freddie Mac together own / guarantee close to 31 million home loans worth about $5.5 trillion, equating to roughly half of all US mortgages.

Osc. DownCrossed SELL Signal : Sold E-Mini S&P 500 at 1122 on the close of Thursday December 24.

Saturday, December 19, 2009

Final Greetings for the Year

I wish you love and friendship too,

May you count your blessings, one by one

May your journeys be short, your burdens light

I wish this all and so much more,

Day Two of Market Timing Strategy

Everyone is waiting for the breakout of the Daily sideways range, now 23 days old.

Everyone is waiting for the breakout of the Daily sideways range, now 23 days old.Is it going to be higher or lower?

Historically, holidays are often accompanied by trend changes in the equity markets. The most noticeable of these is the year end holidays.

Trends that remain in place past November's Thanksgiving holiday usually continue until the beginning of the new year. Then in the first or second week of January the trend ends. This phenomenon was clearly observable in 2008 and 2009, and in four of the past five years

Fridays's action was split, with the NASDAQ 100 rallying immediately after a strong gap up opening, but with the Dow and the S&P 500 initially sliding below yesterday's lows and then bouncing to modestly green closes. All in all, the major indexes continue their range-bound trading, with the NASDAQ 100 currently closer to its 2009 highs than the S&P 500 and the Dow. In fact, the Dow - long the leading index - is now underperforming.

The internals are no longer confirming the market. Banking and housing are but a couple of examples of relative weakness, which also serve as warnings. Yet, the mainstream media and politicians have the masses lulled to sleep. In my opinion this is a great disservice as it only helps to set the stage for the slaughter that will ultimately follow once the Phase II decline begins. In the meantime, the longer this bear market rally lasts, the more damaging it will ultimately be once it is over.

The E-Mini S&P500 ( ES ) closed the week one tick above the 20 Day Moving Average. The US Dollar Index close the week above the Daily Green MA and above the key resistance 77.50, first time since April . There is a high probability that the ES will gap higher before it opens on Monday.

Notable about Friday's session was the relative absence of the sharp volatility often seen during quadruple witching days, but then again, the market has been characterized by low volatility and range-bound, uneventful trading for at least a month. Volume was very high however, largely due to issues being added / dropped from the S&P 500 index. Volume production on the S&P 500 was 47% above the index's average daily volume generation seen over the past three months. 5,644 million shares changed hands on the index traded today.

Technology issues were clearly in the lead today - notice the difference in the trading patterns between the Nasdaq 100 (very strong gap up opening and an uncorrected surge to the top of its recent range near 2009 highs) and the Dow and the S&P 500 (an early dip below yesterday's lows with a subsequent intraday recovery, but much weaker closes clearly off the 2009 highs). Market observers explain the pattern with two large-cap technology issues boosting investor confidence for a recovering economy: Both Oracle and Research in Motion (as discussed yesterday) reported earnings that beat expectations. Oracle provides software for large businesses, and its positive earnings make the case that such companies are becoming more willing to spend on technology. While consumer spending has not (yet) picked up, the fact that business spending appears to be improving is a step in the right direction, analysts comment.

According to a number of market observers, the market is now more or less 'shut down' for the year, with a continuation of range-bound trading likely, given that large players with notable gains are not willing to put their winnings at risk. Others still believe however that we will see a continuation of the Santa Claus rally, suggesting that the strongest two weeks of the year are still to come (starting December 21) and that stocks will thus see more upside.

Next week will be abbreviated due to the Christmas holiday, yet the economic data calendar is loaded with plenty of economic data to be released on GDP, consumer confidence, home sales, import prices, demand for Durable manufactured Goods, and more. The key report is going to be Durable Goods on Thursday after the 2yr, 5 yr and 7 yr Note Announcement on wednesday.

Review of Options Exp Friday

Posting here from my Log Cabin in the middle of the Mountains, cold as hell outside. My traditional wood burning Fireplace is running full throttle.

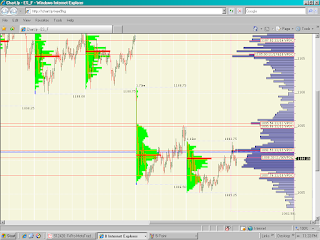

The First Hour High 1099 is not shown in the chart picture and it was only half a point below the Previous Day-High ( HOD )

The Gap fill probabilities was 63% for the particular Market Conditions. The Pivot was just above the Prev Close at 1095. The key to the gap fill trade was the Bearish Pin Bar formed after a rejection of the Confluence Resistance Power Zone and the fact that it opened above the Prev VAH ( see chart pic ) which was a no brainer.

Wednesday, December 16, 2009

Heading to the Mountains for some Skiing

If we had no winter, the spring would not be so pleasant: if we did not sometimes taste of adversity, prosperity would not be so welcome.

There is a privacy about it which no other season gives you.... In spring, summer and fall people sort of have an open season on each other; only in the winter, in the country, can you have longer, quiet stretches when you can savor belonging to yourself.

Wishing every visiter of this Blog a wonderful Holiday season. Good luck and good trading

End of Year Trading Tips :

Look before you leap is one of the first adages we are taught as children. It should be should the first one we are taught as traders.

I am certain I have lost more money trading, had more losing trades because I got in too soon, rather than because I got in too late. I should have looked before I leapt.

This is a real problem I have had. So I am certain you will have it as well, if you have not already experienced it. The attraction to making money, for people like us, is greater than the potential risk. We are driven more by greed than we are by fear.

We have learned to essentially see what markets are going to do. We learn to predict things, and we have learned to look forward. Thus, we are afraid more of losing the money we "could have made" than losing money we have in our pockets. That's the emotional Achilles heel of traders. Overcome it, and you will succeed.

So how do we get around this, what we should do to resolve the situation?

To me, the most helpful thing I have done is to have a checklist to make certain that at least three or four elements of a winning trade are in play. Not on my checklist? Then I simply can't take the trade. I need my checklist to make certain I am not just playing Kamikaze Cowboy. This forces me to a delay my emotions and the use of my strategies.

It's a little bit like hunting. Once you get your game in site there are three steps to go through; the first is to breathe, secondly to aim and finally, squeeze the trigger. You can't rush into this... it's the same with trading.

I have learned to wait, to be deliberate, to realize almost every trade I entered in my entire life has gone against me, which means 98% of the time there has always been a better place to get in. And for certain, the more emotional I have been about getting into a trade, the worse my entry was. The path of correct action is not an easy one to follow.

It really is the fear of losing the potential money that drives us to act too quickly, to leap before we look. So keep in mind there is plenty of money to be made trading, and there'll always be plenty of trades just around the corner. It's not the good trades that kill you. It is the bad trades we jumped into too quickly, the bad entries. For big pay, learn to delay.

Good Luck & Good Trading.

Tuesday, December 15, 2009

Live Account Updated

Trading Method:

Combination of price action, DOM reading scalping, and other market internals setups.

Long ZBH10 117-08

Exit of trade before target at 118-04 .NO regrets.

Profits: + 28 ticks or $875 per contract

Reason for early exit:

FED Day, Equities Indices price action and other clues

Long setup worked like a champ... Out Flat

Monday, December 14, 2009

Market Timing Swing Position Update

Saturday, December 12, 2009

Retail Sales Day Review

Friday, December 11, 2009

US Dollar albatross now hangs around the Bull's neck as it has broken to the upside.

Brazil leads the world in exporting Orange juice, Sugar, Coffee, Beef and Chicken, CNBC's Erin Burnett reported live from Rio de Janeiro, Brazil.

Brazil leads the world in exporting Orange juice, Sugar, Coffee, Beef and Chicken, CNBC's Erin Burnett reported live from Rio de Janeiro, Brazil.When I spend months in Rio back in 1982, my personal driver and bodyguard was a former police officer and he told me many stories of street gangs that were arrested and executed on the spot in the streets of Rio's "Fabelas". I used to think that US police officers were inclined to be brutal with excessive force !

Two Treasury Auctions gone bad and the Dollar starting an uptrend.

NO, it doesn't look good for Equity Indices. As long term interest rates go up less home and commercial loans and mortgages are made and small businesses will also be affected.

When long term rates go up with the dollar also appreciating at the same time the combined effect on businesses is much higher.

The day's top news was released by the Commerce Department; it reported that November retail sales (as indicated by the so-called Advance Retail Sales Report) had grown unexpectedly by 1.3%, above the consensus estimate of a rise of merely 0.6%. Excluding autos, sales were up 1.2%, also better than the anticipated rise of 0.4%. Furthermore, consumer confidence also appears to be on the mend. The Reuters / University of Michigan Consumer Confidence Index also rose, exceeding analysts' expectations. Even more positive economic news emerged, as business inventory data came in higher for the first time in over a year as well.

Crude oil futures have been tumbling lately, now down eight straight sessions - the longest losing streak in some six years - to below the psychologically significant level of $70 a barrel. The recent rebound in the US dollar is largely to blame for this; the greenback surged to its highest level in two months today following stronger consumer confidence data. Crude oil continued to slide today even though the International Energy Agency had released a report stating that world demand for oil would increase in 2010 somewhat more than previously forecasts. And the commodity was weak even in the wake of reports from China about strong growth in that country's industrial production.

Analysts comment how today's trading showed 'extra-light' volume. We are also seeing multiple references to a Santa-Claus rally, although some commentators warn that after a more than 60% rise off the March lows, Santa may not necessarily be visiting Wall Street this year. On the other hand, it is noteworthy to point out that the broad market has been able to rise for two days in the face of a strongly rising US dollar. The old pattern of higher dollar, lower stocks may thus be starting to wane, or even break. The US Dollar Index gained 0.8% over the last two sessions.

Despite today's upside, the market showed a split performance. The Dow outperformed, the S&P 500 advanced modestly, but the Nasdaq lagged and closed red, due to weakness among large-cap tech issues and in the semiconductor space (the Philadelphia Semiconductor Index lost 1%).

Thursday, December 10, 2009

The Bull is on the Last Leg and Ready to Fall

This market is still in a sideways range near a Key Fibonacci retracement from the Long term downtrend. The Dollar ( Exports ) and the carry trade will not help this market go UP any further. It will have to be another catalyst to drive this market higher.

This market is still in a sideways range near a Key Fibonacci retracement from the Long term downtrend. The Dollar ( Exports ) and the carry trade will not help this market go UP any further. It will have to be another catalyst to drive this market higher.The US Labor Department released its latest statistics on unemployment benefits today, and the data paints a picture of a still very sluggish labor market. The week ending December 5 saw 17,000 more people filing new claims for unemployment benefits, boosting the total number of claims to a seasonally adjusted 474,000. First-time claims are a measure of the number of new layoffs. Economists had been expecting the number of initial claims to drop to 450,000; today's number was thus a disappointment. Equally troublesome was the fact that the total number of people claiming benefits of any kind (for the week ending November 21) swelled by 417,000 to now in excess of 10 million.

According to the financial press, investors brushed aside this negative employment picture because of the news that rising exports had helped narrow the US trade deficit in October. According to the Commerce Department, the US trade gap shrank to $32.9 billion in October, in spite of economists having anticipated an increase. US exports were boosted by the weak US dollar, which makes American goods cheaper overseas. A smaller trade imbalance deficit is seen as a positive, as it stimulates the gross domestic product (GDP).

Interestingly, the market gained ground today in spite of a modestly stronger US dollar (the dollar index was up 0.1% for the day). In recent months, US dollar strength has often led to weakness in the equity market. Of concern for the broad market is however the weakening financial sector (financials overall lost 0.2% today). Rumors that Citigroup will have to raise a new equity stake in order to repay its TARP funds were seen as a key contributing factor. Some market analysts also cite the fact that that the US treasury Secretary is making the case for an extension of the $700 billion TARP plan (we discussed this yesterday) as a cause for concern, as it underscores that the US financial system remains frail.

Tomorrow is seen as a crucial day in terms of economic data. Retail sales, as well as consumer sentiment and business inventory data will be released and may have a market-moving impact.

Wednesday, December 9, 2009

Swing target filled on both Positions-Out Flat

+24 pts of profits per contract or $1,200 each !.

Holding short the 1105 ESH10 ( New March Contract) for lower target

Swing trade worked like a champ ! See previous posts and charts for the analysis.

Tuesday, December 8, 2009

Previous Analysis Worked as Expected

Monday, December 7, 2009

New Swing Position

Sunday, December 6, 2009

Another Brilliant Observation

Saturday, December 5, 2009

The EURO Leads the way down..

The EURUSD has made a significant close below a key Daily Trend Line ( not shown on this chart)

Here is why this is an important correlation in intra-market analysis.

Weekly View Assessment of The Trend

Three weeks ago there was another breadth surge. This time it was a 16 to 1 up vs. down volume rally on the NYSE. Watching for a second such day to confirm a bullish signal based on this indicator.

The target for this rally is still SPX 1119.31, only 1.1% higher based on Friday's close. A decisive close above SPX 1119.31 would point to a run to the next resistance level, at SPX 1226.

Unemployment Report Stuns Wall Street but doesn't fool some traders

Friday, December 4, 2009

Bearish Signs In the Cash Index SPX

There is a high probabilty that prices will drop next week.Will look for a short entry in the $ES_F on Sunday night Globex session.

There is a high probabilty that prices will drop next week.Will look for a short entry in the $ES_F on Sunday night Globex session.

Payrolls Day Review

Sunday, November 29, 2009

Weekend Long Term Perspective

Thursday, November 26, 2009

Wishing all a Happy Thanksgivings

Wednesday, November 25, 2009

Day-Trading Account Performance

Tuesday, November 24, 2009

Buy Limit FILLED at 1098.50 and 1096.50

Monday, November 23, 2009

The Scenario Becomes Reality

Another Low Risk Trade Executed from Sunday night

Here is the result of another trade executed during the Sunday Globex session. The setup and analysis for the entry is proprietary since this is not a recommendation for anyone and I do not trade to live up to anyone s expectations.My trading account is growing quickly and that is enough satisfaction for me. Don't need any credit or cheerleading from anyone.

Here is the result of another trade executed during the Sunday Globex session. The setup and analysis for the entry is proprietary since this is not a recommendation for anyone and I do not trade to live up to anyone s expectations.My trading account is growing quickly and that is enough satisfaction for me. Don't need any credit or cheerleading from anyone.Like many other traders ( most of them simulating ) in $ES_F StockTwits my trades have been posted after the fact but with the Live Performance Record also posted in Twitter.However since 95% of other traders in ST are not live trading and do not know how to trade I have desided not to share my trade entries again in that medium.

Detailed Profile Compliments of My Secretary at Large

Profile for Monday 11-23

Sunday, November 22, 2009

60min - View of the Trend and Projections

Saturday, November 21, 2009

Opt.Exp Friday Price Action Review

Review Complements of Twitter

Friday, November 20, 2009

Day 2 of Market Timing Strategy

Recent Data:

Thursday, November 19, 2009

SHORT Position closed and reached Target as expected

Final target filled at 1087.50 for a gain of + 21 pts profits. The low was 1086.50.The short position was posted at 10pm on Wednesday evening.

The previous volume profile chart " Targets Above Monday's High" posted by my Secretary on Tuesday at 2:50am was for Wednesday's trading session and some idiots in Twitter/StockTwits made comments suggesting that my SHORT position on Thursday was a result of that previous chart which only showed price levels and NO projected market direction.That only shows the low level of IQ and stupidity of some people in $ES_F StockTwits.

Wednesday, November 18, 2009

Low Risk SELL Setup

Review for Tuesday Nov 17

Tuesday, November 17, 2009

I-love-to-throw-counterfeit-money-from-my-helicopter

Monday-November-16-Retail Sales

Review of price action on this Retail Sales Day with after market follow through and some easy notes....

Another Useful Study for Day-Trading

It helps when you have a hard working Secretary doing the research. lol

This is for the E-Mini S&P500 ( ES )

New Research/Study

Saturday, November 14, 2009

Review of Friday's Price Action