The third quarter of 2009 is now over and it produced the best gains the broad market has seen since 1998. Both the S&P 500 and the Dow sported gains of more than 15% over this time span. Following are some more detailed statistics about the broad market's significant gains in recent months:

The NASDAQ Composite gained 15.7% this quarter and has now rallied more than 67% off its March lows. The S&P 500 gained 15% this quarter and is up more than 56% from its March lows; however, it remains 9% down from a year ago and is still more than 32% off its October 2007 high. Finally, the Dow has also gained some 15% this quarter and is up more than 40% from its March low. Currently, the Dow remains a little over 21% below its October 2007 peak. Many analysts continue to remain largely bullish on the market, saying that even modest pullbacks will be seen as buying opportunities. In contrast, it appears not all investors agree: According to the American Association of Individual Investors, the degree of investor bearishness recently stood at 44.5%, a number that exceeds the long term average of 30%.

Among today's economic data releases, there was positive news on the second-quarter gross domestic product offset by a surprising decline in the Chicago Purchasing Managers Index (a measure of Midwestern manufacturing activity) in September.

Tomorrow is the first trading day of the fourth quarter and may present a challenge to investors as the Institute for Supply Management is set to report on manufacturing activity in September. A larger test is however scheduled for Friday, where the government will deliver its monthly jobs report.

Wednesday, September 30, 2009

Key Reversal from 1042

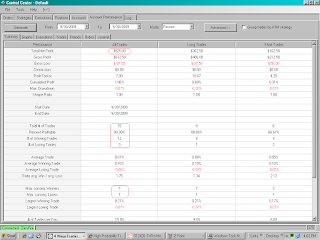

My trading Performance has steadily improved and there are only a few minor adjustments in regard to the Entries which need to be more précised. The more precision in the execution of the Entry, the tighter is the placement of the stop loss.

Short from 1059 Low Volume Gap under 1052

The Clue:

Yesterday Volume profile in C Period indicated Minus Development showing Directional Cash Flow DOWN, with above Average Volume in C Period ( Third 30min period )

Monday 9-28 SOLD 1059 This is a Monthly POC-Target filled at 1042.25 Last Friday POC for +16.25 Pts = $837.50 Profit

Yesterday Volume profile in C Period indicated Minus Development showing Directional Cash Flow DOWN, with above Average Volume in C Period ( Third 30min period )

Monday 9-28 SOLD 1059 This is a Monthly POC-Target filled at 1042.25 Last Friday POC for +16.25 Pts = $837.50 Profit

Monday, September 28, 2009

Long at 1041 : Target filled

Long at the close of Friday at 1041 (ESZ9) E-Mini S&P 500 Futures.

First Target reached at 1060 for + 21 Points profits. Daily price action found support exactly at the 20 DMA. The Market Timing Strategy worked like a champ again !

The S&P 500 generated a volume of 3,017 million shares today, 29% above the index's average daily volume output seen over the past three months.

Today's rally has largely been attributed to a recent increase in merger and acquisition (M&A) activity. Three such M&A deals were announced today: Xerox will acquire Affiliated Computer Systems for $6.4 billion in cash and stock; Abbott Labs will acquire Solvay's drug business for 6.6 billion in cash; and finally, GenTek will be taken over by American Securities who will pay $38 per share for the company.

Market observers comment positively on the current takeover and merger activity, saying that it is an important milestone in the recovery of the financial system. During the financial crisis, such activity had slowed to a mere trickle.

Financials were the best performing market sector today, up a hefty 3.4%. This is the sector's strongest single-session advance (on a percentage basis) in roughly 2 months. Within the financial sector, multiline insurers gained 6%.

Despite today's impressive upswing, market commentators note that there did not appear to be much conviction behind the move with total trading volume on the NYSE coming in well below one billion shares, its lowest level in a month. However, it must be noted that many market participants were away for Yom Kippur, the holiest day of the Jewish calendar. The third-quarter of 2009 ends on Wednesday and may have prompted some money managers to play catch up with the market. The Dow is currently up 16% for the quarter, on pace to achieving its best three-month stretch since the last quarter of 1998 (where it gained more than 17%).

First Target reached at 1060 for + 21 Points profits. Daily price action found support exactly at the 20 DMA. The Market Timing Strategy worked like a champ again !

The S&P 500 generated a volume of 3,017 million shares today, 29% above the index's average daily volume output seen over the past three months.

Today's rally has largely been attributed to a recent increase in merger and acquisition (M&A) activity. Three such M&A deals were announced today: Xerox will acquire Affiliated Computer Systems for $6.4 billion in cash and stock; Abbott Labs will acquire Solvay's drug business for 6.6 billion in cash; and finally, GenTek will be taken over by American Securities who will pay $38 per share for the company.

Market observers comment positively on the current takeover and merger activity, saying that it is an important milestone in the recovery of the financial system. During the financial crisis, such activity had slowed to a mere trickle.

Financials were the best performing market sector today, up a hefty 3.4%. This is the sector's strongest single-session advance (on a percentage basis) in roughly 2 months. Within the financial sector, multiline insurers gained 6%.

Despite today's impressive upswing, market commentators note that there did not appear to be much conviction behind the move with total trading volume on the NYSE coming in well below one billion shares, its lowest level in a month. However, it must be noted that many market participants were away for Yom Kippur, the holiest day of the Jewish calendar. The third-quarter of 2009 ends on Wednesday and may have prompted some money managers to play catch up with the market. The Dow is currently up 16% for the quarter, on pace to achieving its best three-month stretch since the last quarter of 1998 (where it gained more than 17%).

Saturday, September 26, 2009

Friday Sept 25 Recap

Over the past three sessions, the major indexes have seen their largest weekly loss since early July. Understandably, market mood has undergone a bit of a shift over the past few days as a perhaps unjustifiably high degree of optimism has given way to some pessimism. Apart from the widespread sense that after a 60% rally off the March lows, the major indexes were a little overstretched to the upside, disappointing reports on home sales and on the manufacturing sector contributed to worries that the US economic recovery might not progress as smoothly and rapidly as some had hoped.

According to new data released by the Commerce Department today, durable goods orders were off by 2.4% in August, an unexpected slide because economists had been calling for a rise of 0.5%. In contrast, durable goods orders had risen 4.8% in July. The numbers are important because they represent a key indicator for the health of the manufacturing industry. In other economic news, it was reported today that new home sales in August were up (increasing to 429,000); however, this represents an increase well below the expectations of market analysts; it is in fact only a shallow improvement compared to four months of strong gains. Again, investors' expectations were not met.

Yesterday's disappointing earnings report from one of the tech sector's flagship companies - BlackBerry maker Research in Motion - served to drag down the NASDAQ Composite Index. Research in Motion's stock tumbled more than 17% today. Analysts comment that the fact that this Wall Street darling missed earnings suggests the economic recovery is still tenuous.

Market observers comment that many investors may be underestimating how long it can take for an economy to recover. On Friday next week, the Labor Department will release its monthly jobs reports (the non-farm payrolls report), one of the most closely watched economic indicators. Other key economic data to be released next week includes the latest numbers on consumer confidence, factory orders, home prices, and manufacturing.

Market Timing Strategy with 84% Win Rate in 12yrs

Long at the close of Friday at 1041 (ESZ9) E-Mini S&P 500 Futures.

This strategy was presented in 2006 at the Traders Expo in Fort Lauderdale, Florida. It was tested for 12 years, and has a Win Rato of 84 %.

The last date it worked was Tuesday,Sept. 1st. The closed was 996.50 - 23.25 and the following day the Long Position was down -5Pts. Two days later on Friday Sept 4th the close was

1014 + 12.25 for a Profit of + 17.5 Points or $875 per contract.

This strategy was presented in 2006 at the Traders Expo in Fort Lauderdale, Florida. It was tested for 12 years, and has a Win Rato of 84 %.

The last date it worked was Tuesday,Sept. 1st. The closed was 996.50 - 23.25 and the following day the Long Position was down -5Pts. Two days later on Friday Sept 4th the close was

1014 + 12.25 for a Profit of + 17.5 Points or $875 per contract.

Friday, September 25, 2009

It is 12:20pm-est The Big Index has reached the 20-DMA

The volume at this level is 16,464 Million , the highest of the day.There will be sideways consoladation at this level and possible reversal later. The E-Mini ( ES ) is very close to the 20 DMA at 1034.75. The 1037.50 Level is the POC from Monday,Sept-14, and this is why the ES is spending time around this Level in sideways trading.

My Second Target has been reached

On a side note: I just cannot understand why people are paying more than $6k for learning how to scalp the E-Mini for only one Point or four ticks. There is a Webinar from an Indian trading guru that only shows testimonials, most of it is a sales pitch, and then he has the audacity to show only one trade where he profits one single point, using only one overused Indicator, risking more than a full point , what a joke !

My Second Target has been reached

On a side note: I just cannot understand why people are paying more than $6k for learning how to scalp the E-Mini for only one Point or four ticks. There is a Webinar from an Indian trading guru that only shows testimonials, most of it is a sales pitch, and then he has the audacity to show only one trade where he profits one single point, using only one overused Indicator, risking more than a full point , what a joke !

Thursday, September 24, 2009

Consoladation Is Expected After A Steep Vertical Down Move

The Index Low is very close to the Daily 20 MA at 1043.25. The next Objective down is the 1022 level.

Today's volume production on the S&P 500 amounted to 4,320 million shares, which is roughly in-line with the index's average daily volume output seen over the past three months.

The broad market continued to pull back today in spite of some better-than-expected jobless claims data; however, the most recent existing home sales numbers were disappointing.

Furthermore, a strong rebound in the US dollar also pressured stocks.Today's economic news shows that initial jobless claims for the week ending September 19 had fallen to their lowest level in two months (current total: 550,000). Furthermore, continuing claims also came in better than expected (6.14 million rather than 6.18 million). While this news was encouraging (notwithstanding the fact that claims numbers remain at uncomfortably high levels), the release of the latest existing home sales data was likely a disappointment for investors. The newest numbers show a 2.7% decline in new home sales in August, representing the first pullback in existing home sales data since March.

In notable tech earnings news, Research in Motion (RIMM), the maker of the popular BlackBerry, reported disappointing earnings after the close today. The company said that fiscal second-quarter profits were off and that revenue for the current quarter would also fall below the expectations of Wall Street analysts. The company's shares tumbled more than 10% in after-hours trading. Earnings were in part impacted by a patent settlement payment; revenues increased from 2.5 8 billion to 3.5 3 billion, but profits per share were down. According to one of the company's co-CEOs, RIMM expects to ship more than 9 million new phones in the current quarter. The company believes its market share of the US smart phone market was about 55% in mid-June (six months earlier, RIMM's market share was about 40%).

Other notable tech earnings came from Hewlett-Packard (HPQ). The company anticipates that it will generate revenue and profit targets in its next fiscal year that are roughly in-line with analysts' expectations. HPQ believes that the personal computer market (which accounts for nearly a third of the company's sales), which has suffered a significant slump during this recession, is now starting to improve. In contrast, the company's printer ink division is seeing less of a jump in demand.

Today's volume production on the S&P 500 amounted to 4,320 million shares, which is roughly in-line with the index's average daily volume output seen over the past three months.

The broad market continued to pull back today in spite of some better-than-expected jobless claims data; however, the most recent existing home sales numbers were disappointing.

Furthermore, a strong rebound in the US dollar also pressured stocks.Today's economic news shows that initial jobless claims for the week ending September 19 had fallen to their lowest level in two months (current total: 550,000). Furthermore, continuing claims also came in better than expected (6.14 million rather than 6.18 million). While this news was encouraging (notwithstanding the fact that claims numbers remain at uncomfortably high levels), the release of the latest existing home sales data was likely a disappointment for investors. The newest numbers show a 2.7% decline in new home sales in August, representing the first pullback in existing home sales data since March.

In notable tech earnings news, Research in Motion (RIMM), the maker of the popular BlackBerry, reported disappointing earnings after the close today. The company said that fiscal second-quarter profits were off and that revenue for the current quarter would also fall below the expectations of Wall Street analysts. The company's shares tumbled more than 10% in after-hours trading. Earnings were in part impacted by a patent settlement payment; revenues increased from 2.5 8 billion to 3.5 3 billion, but profits per share were down. According to one of the company's co-CEOs, RIMM expects to ship more than 9 million new phones in the current quarter. The company believes its market share of the US smart phone market was about 55% in mid-June (six months earlier, RIMM's market share was about 40%).

Other notable tech earnings came from Hewlett-Packard (HPQ). The company anticipates that it will generate revenue and profit targets in its next fiscal year that are roughly in-line with analysts' expectations. HPQ believes that the personal computer market (which accounts for nearly a third of the company's sales), which has suffered a significant slump during this recession, is now starting to improve. In contrast, the company's printer ink division is seeing less of a jump in demand.

9:05am SOLD ESZ9 @1062 Market traded down to 1043.25

Trade developed and executed as expected. First Target reached at 1044 for 18 Points Profits

Wednesday, September 23, 2009

As expected and previously posted on this Blog the Daily has done a classic reversal pattern on FED Day. Yes , we all know about the "Fed Pattern" which is not as reliable as we may like it to be.

The Ouside Day and Bearish Pin Bar Reversal on the Daily after a new contract High however is a much more reliable SELL Signal to be highly trusted. The S&P500 closed under the UP Trend Channel Support 1062.60 today which is another Omen for the big Index. It has closed under the 20 Daily Moving Average twice before in August and September and both times it has reversed within two days. Therefore to be a true continuation of the Weekly Downtrend it would have to go down to the 50 DMA at 1008 and close below it without reversing.

What about Volume? Today's volume output on the S&P 500 amounted to 4,332 million shares, which is roughly in-line with the index's average daily volume output seen over the past three months. The E-Mini Volume today was 16% less than yesterday.

We can expect prices to go down to at least 1035 (1042 on the SPX) if not lower. My trade is to SELL at 1062.

It appears that the Federal Reserve gave investors a good excuse to take some profits off the table. In a fairly typical 'buy-the-rumor-sell-the-news' reaction, the market ran up to new 2009 highs ahead of the FOMC meeting today. Roughly half an hour after the news was released, large market players decided to books some profits; after all, the major indexes are now up close to 60% in a mere six months and another earnings season is approaching.

The Fed's policy statement contained nothing truly unexpected. It reiterated that economic activity has started to increase and revealed that the Fed would leave interest rates (i.e., the Fed funds rate) unchanged (in a range between zero and 0.25%), possibly 'for an extended period'.

The Fed further announced it plans to purchase $1.25 trillion of agency-backed securities, as well as acquire $200 billion of agency debt. Other liquidity-boosting measures will be trimmed back, such as the $300 billion of long-term Treasuries (to be completed by October)

Two further signs of a strengthening US economy: Ford reported that it anticipates vehicle sales to be on the upswing; General Mills reported better-than-expected earnings and issued upside guidance.

The Ouside Day and Bearish Pin Bar Reversal on the Daily after a new contract High however is a much more reliable SELL Signal to be highly trusted. The S&P500 closed under the UP Trend Channel Support 1062.60 today which is another Omen for the big Index. It has closed under the 20 Daily Moving Average twice before in August and September and both times it has reversed within two days. Therefore to be a true continuation of the Weekly Downtrend it would have to go down to the 50 DMA at 1008 and close below it without reversing.

What about Volume? Today's volume output on the S&P 500 amounted to 4,332 million shares, which is roughly in-line with the index's average daily volume output seen over the past three months. The E-Mini Volume today was 16% less than yesterday.

We can expect prices to go down to at least 1035 (1042 on the SPX) if not lower. My trade is to SELL at 1062.

It appears that the Federal Reserve gave investors a good excuse to take some profits off the table. In a fairly typical 'buy-the-rumor-sell-the-news' reaction, the market ran up to new 2009 highs ahead of the FOMC meeting today. Roughly half an hour after the news was released, large market players decided to books some profits; after all, the major indexes are now up close to 60% in a mere six months and another earnings season is approaching.

The Fed's policy statement contained nothing truly unexpected. It reiterated that economic activity has started to increase and revealed that the Fed would leave interest rates (i.e., the Fed funds rate) unchanged (in a range between zero and 0.25%), possibly 'for an extended period'.

The Fed further announced it plans to purchase $1.25 trillion of agency-backed securities, as well as acquire $200 billion of agency debt. Other liquidity-boosting measures will be trimmed back, such as the $300 billion of long-term Treasuries (to be completed by October)

Two further signs of a strengthening US economy: Ford reported that it anticipates vehicle sales to be on the upswing; General Mills reported better-than-expected earnings and issued upside guidance.

Tuesday, September 22, 2009

Friday 9-18 : SHORT From 1061 : Target 1052 reached . Trade executed as expected

The odds now favor a drop below the 1050 level and eventually a move to 1035. The market should find good support near 1035

The Sept 15 COT Report shows the Spec and Fund Position Net Long more than 30k contracts in the S&P500.The Bear Camp has the Edge

The Sept 15 COT Report shows the Spec and Fund Position Net Long more than 30k contracts in the S&P500.The Bear Camp has the Edge

Monday, September 21, 2009

Two Major Technical Forces Are About to Stall the S&P 500 Advance

First is the Fibonacci retracement Level of 50% at about 1122 and

Second is the Daily Trendline from the October 2007 High.

Today's weak performance of the S&P 500 and the Dow confirmed short-term outlook that the bearish side stands to gain some momentum soon and that the market is now setting up for a downside reversal.

On the S&P 500, we saw a volume output of 3,806 million shares today, 10% below the index's average daily volume production over the past three months.

While the broad market faced some selling pressure today, strength in biotech stocks boosted the NASDAQ Composite which rose 0.24%. On the S&P 500, only the healthcare sector gained ground.

Technology stocks as a group also traded marginally higher, with the notable exception of Dell, which announced it would buy Perot Systems for $3.9 billion (or $30 per share in cash). The transaction amount represents a 70% premium to Perot's stock closing price from last Friday. Perot is a technology services provider headquartered in Plano, Texas and has more than a thousand customers, among them the US military and the Department of Homeland Security. Close to half of Perot's revenues (in 2008: 117 million on sales of 2.8 billion) come from the healthcare industry; a quarter is from government contracts.

Energy and materials stocks saw the steepest losses today, oil futures dropped below the $70 per barrel. In fact, commodities were weak across the board with the CRB Commodity Index down more than 2%, its strongest single-session loss in more than a month. Commodity weakness was exacerbated by gains in the US dollar.

In economic news, the Conference Board announced that its index of leading economic indicators was up by 0.6% in August. While the number is 0.1% below economists' expectations, it is still considered a further sign that the US recession may be over, or nearly over. It was a fifth month in a row that the index of leading economic indicators has increased.

Second is the Daily Trendline from the October 2007 High.

Today's weak performance of the S&P 500 and the Dow confirmed short-term outlook that the bearish side stands to gain some momentum soon and that the market is now setting up for a downside reversal.

On the S&P 500, we saw a volume output of 3,806 million shares today, 10% below the index's average daily volume production over the past three months.

While the broad market faced some selling pressure today, strength in biotech stocks boosted the NASDAQ Composite which rose 0.24%. On the S&P 500, only the healthcare sector gained ground.

Technology stocks as a group also traded marginally higher, with the notable exception of Dell, which announced it would buy Perot Systems for $3.9 billion (or $30 per share in cash). The transaction amount represents a 70% premium to Perot's stock closing price from last Friday. Perot is a technology services provider headquartered in Plano, Texas and has more than a thousand customers, among them the US military and the Department of Homeland Security. Close to half of Perot's revenues (in 2008: 117 million on sales of 2.8 billion) come from the healthcare industry; a quarter is from government contracts.

Energy and materials stocks saw the steepest losses today, oil futures dropped below the $70 per barrel. In fact, commodities were weak across the board with the CRB Commodity Index down more than 2%, its strongest single-session loss in more than a month. Commodity weakness was exacerbated by gains in the US dollar.

In economic news, the Conference Board announced that its index of leading economic indicators was up by 0.6% in August. While the number is 0.1% below economists' expectations, it is still considered a further sign that the US recession may be over, or nearly over. It was a fifth month in a row that the index of leading economic indicators has increased.

SHORT Position reached Target as expected

The odds now favor a drop below the 1050 level and eventually a move to 1035. The market should find good support near 1035.

Sunday, September 20, 2009

Short SETUP Develops with Low Risk

Professionals added to their Short positions this week. The Commitment of Traders reading is -7.2% of total open interest, up from -6.5% last week. The Large contract ( S&P) professionals are still more bearish that the Mini (ES) contract Professionals .

SETUP: Inside Day ( NR6 ) Bearish Doji Formation on the Daily ESZ9 Futures. RSI(2) 71 Down from 100 Oberbought Reading.

Entry : SELL Prev Close at 1061.00 Target : 1052

Next Wednesday 9-23rd is "FED Day" or FOMC Announcement. The last FOMC rate change announcement on 12 August 2009 when the FOMC kept the rate in the 0% to 0.25% range. Two days later the Market Dropped below the Support of the FED Day.

It is very likely this will happen again , not exactly but it will probably drop within a day or two of the Announcement.

SETUP: Inside Day ( NR6 ) Bearish Doji Formation on the Daily ESZ9 Futures. RSI(2) 71 Down from 100 Oberbought Reading.

Entry : SELL Prev Close at 1061.00 Target : 1052

Next Wednesday 9-23rd is "FED Day" or FOMC Announcement. The last FOMC rate change announcement on 12 August 2009 when the FOMC kept the rate in the 0% to 0.25% range. Two days later the Market Dropped below the Support of the FED Day.

It is very likely this will happen again , not exactly but it will probably drop within a day or two of the Announcement.

Subscribe to:

Posts (Atom)