Saturday, October 31, 2009

Profile Assessment and Outllook Into Next Week

Another U-Turn in the Market

Trick or Treat Holloween, watch the bounce and SELL it BIG !

Have investors been tricked or treated as October comes to a close? Well, a bit of both it seems. Early in month positive earnings, Obama Administration proclaiming the recession is over and CNBC hailing the bull is back when the Dow Jones Industrial Average closed above 10000 for the first time since the bear began growling. It seems as though the investor was on the Halloween Treat “sugar high” early. But as we all know what happens when that sugar high loses its effect, we get the inevitable “trick” let down.

After yesterday's almost euphoric rise, today's slump hit the bulls hard. Looking back over the last nine trading days or so, the sharp increase in volatility and in the intraday ranges of the major indexes (not to mention investor sentiment) becomes apparent. Some market observers attribute this sudden volatility to the Forex market, which has recently shown a large influence (correlation) on the stock and commodities markets (with a consistently lower US dollar contributing to sizable gains in commodities and equity markets). Today, the US dollar continued its recent surge against a basket of major currencies (yesterday, the inverse pattern could be observed).

However, there were also economic news releases that contributed to today's significant u-turn in the market. Yesterday, market observers had cheered rising GDP numbers; today, the health of the US consumer became a key concern after the Labor Department announced that in September personal spending had declined by 0.5%, the largest slide in nine months. At the same time, new data shows that personal income came in flat in September (as compared to August). Also perceived as negative, the latest reading on the Reuters/University of Michigan consumer sentiment index came in lower as well, declining from a reading of 73.5 in September to a value of 70.6 in October.

Market observers note that the volatile trading we have been seeing may continue for the time being until we get more stable (or improved) employment numbers. Consistent income and spending growth can only come with labor market improvements, according to one economist. Next week will bring a significant amount of new data from the economic front; consult the section below for details.

Exacerbating today's selling was a renewed fear about the health of the financial sector. Making headlines was CIT, which appears headed for a bankruptcy filing. Adding to the malaise, an influential market analyst suggested Citigroup would have to take $10 billion of write-downs this quarter. And finally, well-known investor Wilbur Ross voiced his opinion that the US was currently at the onset of a 'huge crash in commercial real estate.'

The remarkable thing about the stock market is the absence of volume associated with it. Compared with previous rebounds in stocks from previous recessions, volume in this recovery from the March lows is 60 percent lower.

American companies' earnings are better than expected partially because of the weakness of the US currency. The dollar is incredibly cheap. Sterling is incredibly cheap. Therefore, as an American company your costs are down.

It is too early to say whether companies' earnings point to a "real" recovery or to a short upwards cycle followed by a downwards one. Clearly we're having an inventory restocking.

Today, the various stimulus packages have also left behind a legacy of debt. We're in a generation where returns disappoint until we deleverage the economy.

China will continue to buy US Treasurys, as a way of ensuring their currency is stable, and the fact that the yuan is not freed from the dollar is creating strains on the European and Japanese economies.

The Chinese are not diversifying the reserves. They cannot diversify, because were they not buying Treasurys, or if they weren't buying dollars, their currency would rise.

Thursday, October 29, 2009

Long Intraday Breakout trade ( ES )

Another winner and its time to hit the beach

in this sunny South Florida Island.

Today's strong rally was characterized by a volume production that was roughly in-line with the index's average daily volume output seen over the past three months. On the S&P 500, 4,335 million shares were traded.

The recent pattern of 'US dollar down - stock and commodity markets up' held again today, with the greenback slipping after 5 consecutive up-days (during which time the broad market showed pronounced weakness), losing 0.6% against a basket of foreign currencies. While this linkage may not hold forever, it certainly played out strongly today, with oil, gold, and the broad market bolting considerably higher while the US dollar sagged once again.

Investors however saw additional reasons why they piled back into stocks today: The big news of the day was the announcement that US third-quarter gross domestic product (GDP) had increased by an annualized 3.5% (above the consensus estimate of 3.2%). In contrast, during the second quarter of this year, GDP had declined by 0.7%. The news of higher GDP readings prompted market analysts to comment that the recession was now finally over - interestingly, the news was released on the 80th anniversary of the stock market crash that had triggered the Great Depression. While some were exuberant, other market analysts commented that much of the growth seen during the third quarter was in fact based on government stimulus money, such as the Cash for Clunkers rebate program and the government tax credits for first-time homebuyers. Skeptics believe that once this stimulus money stops flowing, the economy will have a hard time sustaining the current pace of growth, 'on its own' so to speak, as the necessary jobs growth is currently lacking.

In other economic news, investors brushed aside stronger-than-anticipated initial jobless claims for the week ending October 24. Rather than the expected 525,000 initial claims, the government reported 530,000 initial claims.

In earnings-related news, Dow component Exxon Mobil missed its consensus estimate but still eked out a modest gain for the session. Meanwhile, Procter & Gamble, also a Dow component, surprised to the upside (and traded higher for the session). Colgate-Palmolive also reported positive earnings, as did Motorola in the tech sector.

Wednesday, October 28, 2009

High Risk Long Position at this level?

Today I was short, but then I read alot of traders scaling to go long and it confused me. I couldn't understand why because the tape just screamed short to me from the start. Anyways, it was distracting to say the least.

Yes, you read about the traders that expect a bounce up at this level because the trend is up and the market is oversold in many commonly used indicators like the Daily RSI. Also there is a Market Timing Strategy that you can read about in my blog.

In my opinion it is very premature to go long and they better be placing a stop at the right level. In other words it would be a high risk long position. You take a look at the daily and see that everytime there was a wide range bar it is followed by a Doji or an Inside Day, then it reversed UP. That is what those traders are expecting. But is it going to happen again?

Tomorrow's Economic GDP Report is the most important of this week and it will move the market through many stops.

Both the SPX and E-Mini closed below the 50 DMA

Today's sell-off was broad-based with nine of 10 S&P 500 sectors in the red. It occurred in the face of a number of better-than-anticipated earnings releases, for instance from Visa which was one of the few companies to buck the downtrend today (its stock closed up 3.6%). Oil major ConocoPhillips also reported better-than-expected earnings; however, the company (as well as the entire energy sector) suffered from the fact that the US dollar gained ground for a fifth consecutive session. Crude oil prices slipped to just below $77.50 per barrel following today's gasoline inventory data.

Today's release of new home sales data was considered a strong disappointment. Whereas expectations had been for 440,000 new units, the Commerce Department reported that new home sales in September came in at only 402,000 units, off 3.6% month-over-month (unit numbers are annualized). Meanwhile, durable goods orders were reported to be up 1% in September, matching expectations; however, the market focused on the surprisingly weak home sales data.

Market analysts comment that the recent batch of better-than-expected earnings releases have not really inspired investors, as the entire earnings season has more or less resulted in a sell-the-news scenario. Only a handful of truly outstanding earnings releases led to notable upside (two good examples are Google and Apple). At this time, the market is also grappling with end-of-season tax loss selling for mutual funds.

Market observers believe another test lies just ahead for the market: The US third quarter gross domestic production (GDP) reading, scheduled for release on a Thursday morning. Analysts expect that the US economy grew at an annualized 3.3% in the third quarter of this year; it would be the first quarter of growth after a record-setting four consecutive quarters of economic contraction.

Short from 1088 and 1082

Tuesday, October 27, 2009

Projections for the Downtrend

Tech Talk:

The sellers have reasserted their control over this market. The E-Minis pulled yet another U-turn, this time on very high volume.

The Conference Board, a private research group, today released the newest data pertaining to its Consumer Confidence Index. Results were disappointing and unexpected, showing a reading of only 47.44 for October (whereas a level of 53.1 had been forecast), the second lowest reading achieved since May of this year. Levels above 100 indicate strong growth whereas readings above 90 show a solid economy. Market observers believe that the outlook for the 'holiday shopping season' is likely to be gloomy given today's low consumer confidence numbers which are a barometer for spending. According to the Conference Board, the outlook is for fewer jobs, lower salaries, as well as a worsening business climate, a poor mix for retailers.

In contrast, the latest installment of the Standard & Poor's/Case-Shiller home price index, a study of real estate transactions in 20 major cities across the US, painted a rosier picture. In August, home prices rose, showing their third consecutive monthly increase, with the home Price Index climbing 1% from its July levels. Home prices currently remain some 30% off their May 2006 peak levels.

As noted above, the Dow outperformed the other major indexes today, trading in the green for a good part of the session. Market analysts attribute this positive divergence to the fact that one of its components, IBM, announced it would double its stock-repurchase plan. As well, strength in energy stocks (for instance of Dow component Exxon Mobil) also contributed to the Dow's relative strength today. A number of key oil companies (Exxon, ConocoPhillips, Chevron, and others) are set to report earnings this week. The sector also profited today from strong earnings released by BP.

Market observers say that trading may continue to be volatile and choppy for the balance of this week as the fiscal year end for many mutual funds approaches. This is often a time where fund managers do some late readjusting of their investment portfolios.

The Clue was in the Pattern

Monday, October 26, 2009

4am Globex-SOLD 1082 E-Mini S&P500

Sunday, October 25, 2009

Existing Home Sales FALL in September 2009

NAR continues to bullshit America with their garbage data and spin, month after month, with few people calling them on it. Well, I’ve had it up to here with their garbage:

Big Rebound in Existing-Home Sales Shows First-Time Buyer Momentum

No, home sales did not rebound — that was purely the result of SEASONAL ADJUSTMENTS

You can see on the NON SEASONALLY adjusted chart, from August to September (Red Bar) Sales actually dropped. In prior years — 2005, 2006, 2007, and 2008 — there was always a big fall from August to September.

Why was this year so different? We have ZIRP (which will eventually go up) and a large 1st time buyers tax credit that is scheduled to expire. Hence, the unusual September activity that does not reflect the traditional drop off.

The tax credit effectively extended the purchase season which is why sales were even this strong. But when you consider the hundreds of billions spent to prop up the housing market, which only resulted in 34k additional sales over last September (one of the worst years on record for housing) and fewer sales YoY in CA, sales were really not that great. When organic sales go away suddenly for the season, which will happen in the near-term whether the tax credit is extended or not, it sets sales and prices up for the largest swings lower we have seen since all this began two years ago.

It is not clear whether the folks at the NAR are dumb as lawn furniture and make these misrepresentations honestly — or whether are just another group of disgusting spin doctors, willfully peddling lies because it helps their own agenda and their thousands of REALTOR members.

Those are pretty much the only options: Idiots or full of shit. (You decide).

In terms of outperformance following a stellar earnings release, Amazon certainly gets five stars. The company reported earnings yesterday after the close and impressed investors and analysts to such an extent that its stock rallied almost 27% today, boosting it to an all-time high. And this on a relatively forceful down-day for the broad market! The company's huge success can be attributed to the fact that more and more consumers are willing to shop on-line. While some people attribute this to overall improving economic fundamentals (i.e., people willing to spend more on discretionary items), some critical voices argue that it is actually a sign of a weak economy, as people are looking to save on sales taxes by shopping online.

While Amazon soared, the broad market sagged today, impeded by a combination of profit-taking after a prolong the rally, unsettling profit forecasts from major railroad companies, and a modest rebound in the US dollar (which put downward pressure on commodities and crude oil). The CEO of one of the leading railroad companies in the world - Union Pacific - suggested the economy might continue to 'limp along' until the unemployment situation improves. Another key railroad company - Burlington Northern - also issued cautious and rather lukewarm profit forecasts. Both railroad companies reported significantly lower profits, revenues, and earnings. Given their status as early indicators of (improving or deteriorating) economic activity, such disappointing forecasts from major railroads generated investor concern.

In economic news releases, the National Association of Realtors announced a 9.4% increase in the sales of existing homes in September, close to double the amount economists had been expecting. However, the number was boosted by a swelling number of home buyers wanting to take advantage of a government tax credit that is set to expire at the end of next month.

Saturday, October 24, 2009

Long Term Tech Talk

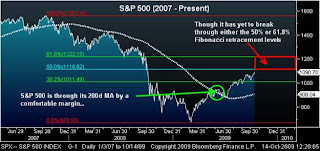

This market has come a long way from the bottom of the pit but it must hold above certain key levels. This process will take many weeks.Here is a comparison with the 2003 change in Trend.

Historically, Supercycle/Cycle bear markets in the US display the following characteristics:

1. They are three Wave structures, an ABC,

2. During the initial decline, wave A, the market loses about 50% of its value, or more;

3. The B wave rally is usually mistaken for a new bull market;

4. The B last anywhere between 23 months and 60 months.

The current Bear market started in Oct 2007, 24 months ago. During the initial decline, wave A, the SPX lost 58% of its value (1576-667). The current B wave rally (667-1101) is being lauded as a new bull market. Wave C of the three wave ABC bear market has yet to unfold.

During Primary wave A the market experienced a crash that lasted over a two week period. This occurred during the last week of Sept 08 and the first week of Oct 08. The mid-point of that crash occurred on friday Oct 3rd at SPX 1099. This week the SPX rallied right into that acceleration point and ran into resistance. All this technical evidence suggests Primary wave B may have ended on Oct 21st at SPX 1101.

Friday, October 23, 2009

Limit SELL 1082 GTC

There is potential for a sizeable selloff next week if we can get acceptance beneath this key level 1070 on the Market Profile Chart.

The E-Mini closed below the Weekly Pivot 1082 and the 4 hour chart has made a second WRB with lower high than the previous one.

The VIX Count is at #11 and the S&P500 ( SPX ) Daily is showing a Bearish Engulfing Pattern. The DOW Transportation Index closed below the 50 Day Moving Average.

There are other important and compelling reasons /clues showing that this market will drop next week.

This Week’s Forex Price Action Indicates Dollar is ready to Rally

The strong recovery in the U.S. Dollar late in the week and the inability to break it sharply lower could be a sign that a short-covering rally is imminent. Rumors the Fed may begin to raise interest rates earlier than expected, a poor U.K. economy and fear of intervention all helped boost the Dollar on Friday.

The uptrend continued on the daily USD JPY chart as rumors swirled that traders are betting the Fed will raise interest rates sooner than expected. Traders who sold Dollars and bought Yen when U.S. interest rates became the lowest in the world are not being forced to buy back their positions. This is helping to boost the USD JPY. There will come a point when the Yen once again becomes the world’s carry trade. The Dollar should rally substantially and equities should break hard when this occurs.

The S&P futures are heading south as investors sell on the news of more positive Q3 earnings coupled with very strong Existing Home Sales data.

However, investors have yet to see a significant improvement in unemployment, and we should keep in mind that both PPI and Building Permits printed below expectations earlier this week. Hence, although Q3 earnings have been impressive, it seems the Fed may have limited ability to drain liquidity over the near-term. Meanwhile, the S&P futures are having a lot of trouble with the psychological 1100 level, and it appears the bulls are a bit worn out.

Investors were caught off-guard by the much weaker than expected Prelim GDP data from Britain. The Pound is getting hammered as a result, a negative development for U.S. equities due to their negative correlation with the Dollar. However, the Euro is holding strong after EU PMI data printed positively mixed. Furthermore, the USD/JPY’s rally is heading past 92 while leaving its psychological 90 level behind. We saw U.S. equities move in a negative correlation with the Cable earlier this month, so investors should be paying closer attention to activity in the Euro and gold for the time being.

That being said, the S&P futures are getting uncomfortably close to the 1st and 2nd tier uptrend lines. These uptrend lines run through October lows and should be viewed as important technical cushions. A reversal beneath these uptrend lines could result in accelerated near-term losses towards 1010 and the psychological 1000 level.

However, bulls shouldn’t get too worried yet since technicals are still supporting uptrends not only in the S&P futures, but also in the EUR/USD, AUD/USD and gold. After all, a selloff on positive earnings is usually a symptom of overbought conditions. As for the topside, 1100 remains the key technical barrier separating the S&P futures from substantial gains.

Thursday, October 22, 2009

Review Of Price Action

SHORT Swing Position exited by the Bull Reversal

Wednesday, October 21, 2009

Mini Miny Moe, Catch the Top and Let it Go, the beast will drop for sure.

SOLD E-Mini S&P500 at 1093 intraday signal

Tuesday, October 20, 2009

Buy the Rumor, Sell the fact

Monday, October 19, 2009

One Apple a Day....

Wall Street Smarts

The statement came from a man sitting three or four stools away from me in a sparsely populated Midtown bar, where I was waiting for a friend.

"But I have to buy you a drink to hear it?" I asked.

"Absolutely not," he said. "I can buy my own drinks. My 401(k) is intact. I got out of the market 8 or 10 years ago, when I saw what was happening."

He did indeed look capable of buying his own drinks - one of which, a dry martini, straight up, was on the bar in front of him. He was a well-preserved, gray-haired man of about retirement age, dressed in the same sort of clothes he must have worn on some Ivy League campus in the late '50s or early '60s - a tweed jacket, gray pants, a blue button-down shirt and a club tie that, seen from a distance, seemed adorned with tiny brussel sprouts.

"O.K.," I said. "Let's hear it."

"The financial system nearly collapsed," he said, "because smart guys had started working on Wall Street." He took a sip of his martini, and stared straight at the row of bottles behind the bar, as if the conversation was now over.

"But weren't there smart guys on Wall Street in the first place?" I asked.

He looked at me the way a mathematics teacher might look at a child who, despite heroic efforts by the teacher, seemed incapable of learning the most rudimentary principles of long division.

"You are either a lot younger than you look or you don't have much of a memory," he said. "One of the speakers at my 25th reunion said that, according to a survey he had done of those attending, income was now precisely in inverse proportion to academic standing in the class, and that was partly because everyone in the lower third of the class had become a Wall Street millionaire."

I reflected on my own college class, of roughly the same era. The top student had been appointed a federal appeals court judge - earning, by Wall Street standards, tip money. A lot of the people with similarly impressive academic records became professors. I could picture the future titans of Wall Street dozing in the back rows of some gut course like Geology 101, popularly known as Rocks for Jocks.

"That actually sounds more or less accurate," I said.

"Of course it's accurate," he said. "Don't get me wrong: the guys from the lower third of the class who went to Wall Street had a lot of nice qualities. Most of them were pleasant enough. They made a good impression. And now we realize that by the standards that came later, they weren't really greedy. They just wanted a nice house in Greenwich and maybe a sailboat. A lot of them were from families that had always been on Wall Street, so they were accustomed to nice houses in Greenwich. They didn't feel the need to leverage the entire business so they could make the sort of money that easily supports the second oceangoing yacht."

"So what happened?"

"I told you what happened. Smart guys started going to Wall Street."

"Why?"

"I thought you'd never ask," he said, making a practiced gesture with his eyebrows that caused the bartender to get started mixing another martini.

"Two things happened. One is that the amount of money that could be made on Wall Street with hedge fund and private equity operations became just mind-blowing. At the same time, college was getting so expensive that people from reasonably prosperous families were graduating with huge debts. So even the smart guys went to Wall Street, maybe telling themselves that in a few years they'd have so much money they could then become professors or legal-services lawyers or whatever they'd wanted to be in the first place. That's when you started reading stories about the percentage of the graduating class of Harvard College who planned to go into the financial industry or go to business school so they could then go into the financial industry. That's when you started reading about these geniuses from M.I.T. and Caltech who instead of going to graduate school in physics went to Wall Street to calculate arbitrage odds."

"But you still haven't told me how that brought on the financial crisis."

"Did you ever hear the word 'derivatives'?" he said. "Do you think our guys could have invented, say, credit default swaps? Give me a break! They couldn't have done the math."

"Why do I get the feeling that there's one more step in this scenario?" I said.

Because there is," he said. "When the smart guys started this business of securitizing things that didn't even exist in the first place, who was running the firms they worked for? Our guys! The lower third of the class! Guys who didn't have the foggiest notion of what a credit default swap was. All our guys knew was that they were getting disgustingly rich, and they had gotten to like that. All of that easy money had eaten away at their sense of enoughness."

"So having smart guys there almost caused Wall Street to collapse."

You got it," he said. "It took you awhile, but you got it."

The theory sounded too simple to be true, but right offhand I couldn't find any flaws in it. I found myself contemplating the sort of havoc a horde of smart guys could wreak in other industries. I saw those industries falling one by one, done in by superior intelligence. "I think I need a drink," I said.

He nodded at my glass and made another one of those eyebrow gestures to the bartender. "Please," he said. "Allow me."

If Wall Street still hired a few affable folks from "the bottom 1/3" of the class, as stated above, the securitization of trillions of dollars worth of bad loans wouldn't have happened. These folks would NEVER have believed that loaning $700,000 to migrant strawberry pickers was a good idea even with the assumption that its risk would be mitigated via the securitization process. Although these folks couldn't do the fancy math required in the CDOs, it wouldn't matter: the very notion of loaning money to people who have no ability to repay it makes said fancy math irrelevant.

Spinning yarn into gold is impossible no matter the math, the hedging, or the securitization. When will the so-called "smart guys" get it?

Saturday, October 17, 2009

Hurdles Remain for the S&P 500

Dow 10,000! Uh Really?

Friday, October 16, 2009

Target filled at 1078.50 for +13.75 Pts or $687.50

Thursday, October 15, 2009

E-Mini S&P500 ( ES )-SOLD 1092.25 at 8:25pm

Market follow through as Expected last Sunday

Second phase of predicted analysis last Sunday has been completed.

This is the 30yr T-Bonds Futures ( ZBZ9 )

December contract

Picture Perfect SETUP

Click on the image for a larger view. Post your answer below.

Wednesday, October 14, 2009

Tuesday, October 13, 2009

The 30yr Bond (ZB) retraced back up to Resistance

As indicated/predicted on Sunday Oct 11 this market retraced back up to the 200 DMA at 121-04. That is were my SHORT Entry was.

Intel earnings pushed the market higher after the close

In today's session, we noted a volume output on the S&P 500 of 3,585 million shares; this is 16% below the index's average daily volume generated over the past three months. The E-Mini had 20% less Volume today.

Investors had to deal with mixed earnings results from some of the stock market's major players today. Early in the session, healthcare products maker Johnson & Johnson disappointed by revealing a 5% decline in quarterly sales. After the close chip maker Intel reported lower third-quarter profits but beat Wall Street's expectations in terms of its profits per share and revenue, also forecasting an increase in gross margins and issuing positive sales guidance for the fourth quarter. Intel shares were boosted strongly in after-hours trading. Key upcoming earnings include JPMorgan Chase reporting on Wednesday tomorrow; Goldman Sachs, IBM, as well as Google reporting Thursday, and Bank of America and General Electric on Friday.

Cisco Systems announced an acquisition today; it will buy network services provider Starent Networks for $2.9 billion. The offer occurs just a few weeks after Cisco made a $3 billion bid for the video-conferencing company Tandberg from Norway.

Just ahead of a slew of earnings reports from the influential financial sector, and with J.P. Morgan reporting tomorrow before the bell, a well-known banking analyst lowered her rating on Goldman Sachs, downgrading the company from 'buy' to 'neutral' on concerns that the shares are now overvalued after a strong run. One fund manager succinctly summed up what investors are looking for at this point: 'The market only makes sense at these levels if earnings can grow at a decent pace...What we're hearing now is OK, but you don't get long-term earnings growth out of cost cutting.'

The broad market once again profited from the slumping US dollar, with the US Dollar Index dropping to a 14-month low against a number of other currencies. Gold and crude oil performed well in this environment, with the former again reaching a new record high above a $1069 an ounce, and the latter climbing to a close over $74 per barrel.

SETUPS are working like a champ today

Did two more trades, that are not included in this picture for another 2 pts profits in the ES.

Monday, October 12, 2009

Not a bad day for Intraday trading: + 7.25 Pts gain

Sunday, October 11, 2009

Tech Talk for the 30yr T-Bonds Futures

Friday, October 9, 2009

SHORT from 122-21 ZBZ9 30yr T-Bonds Futures

3,859 million shares were traded on the S&P 500 in today's session. This volume production was 10% below the index's average daily volume output generated over the past three months.

An encouraging start to the current earnings season coupled with a number of positive economic news releases contributed to today's rally where the broad market advanced for a fourth consecutive session. US dollar weakness also contributed to further upside in equities. While Alcoa's results were undoubtedly encouraging, the real test for this young earnings season comes next week when many financial companies are scheduled to report.

Material and some commodity stocks benefited both from higher commodity prices as well as from Alcoa's upside earnings surprise, although Alcoa's gains itself remained limited to just over 1%. Gold was once again outstanding, climbing to a new intraday record high of over a $1062 (and then once again closing above the $1000 per ounce threshold). Oil futures also barreled higher, boosting the broad energy sector which outperformed the broad market today.

Notable was the better-than-expected number regarding weekly jobless claims. The number of claims for the week ending October 3 fell by 33,000 to 521,000, below the 540,000 economists had been expecting. Continuing claims were also on a downward trajectory, declining by 72,000 to 6.04 million; here, the consensus estimate had been for 6.11 million continuing claims. Although coming in better than expected, these numbers are still very high. It can also not be overlooked that the reduction in the number of claims is often the result of jobless benefits having expired for the claimant.

Additional positive news also emerged from the retail sector. According to new data released by the International Council of Shopping Centers and by Goldman Sachs today, in September, retail sales saw their first gains in over a year.

Monday, October 5, 2009

Sell Signal In T-Bonds 30yr Futures as expected

Daily Bearish Signal in the ZBZ9 30yr T-Bonds Futures means that the S&P will reverse if the T-Bonds fall. It may happen on Tuesday of next week. Also there is an 86% chance of a reversal for the SPX after it decline the last 2 days of a quarter.This suggests a decent upside edge for the next couple of days. Stay Tune.

Today that is exactly what transpired and my Sell Order was filled. Now SHORT from ZBZ9 @122-21 as posted in Twitter.The first Target is the Trend Line Support at 122-00.Second Target is 121-16.

ZBZ9 30yr T-Bonds Futures TechTalk :

Today was and Bearish Inside Day after a Bearish Daily Pin Bar on Friday.

The COT Spec and Fund Position : Net SHORT 59,678 compare that with November 2008 at 161,856. The Treasury market as a whole clearly retains more short covering capacity.

Fundamentals:

According to the newest reading on the Service Index maintained by Institute for Supply Management, the US service industry has just seen its first burst of growth in roughly a year, with the index rising to a level of 50.9 in September (from a reading of 48.4 in August). On this index, a level of 50 is the line that delineates economic growth from economic contraction). The last time the Index was near 50 was in August of last year. Improving ratings on the service Index show increasing confidence in the economy (and its recovery), one analyst commented.

A further driver of today's rally was US dollar weakness (which has lately tended to benefit stocks and commodities) and a Goldman Sachs ratings upgrade on large-cap banks; the Goldman upgrade boosted the entire financial sector. The rally was also fueled by higher oil prices. Because of a Jewish holiday, today's stock market advances occurred on the lighter than usual trading volume which can exaggerate price moves.

Looking somewhat ahead, the earnings season for the July to September quarter starts soon. It will be interesting to see whether companies that previously managed to beat second-quarter profit expectations by means of cost-cutting and job elimination will now be able to show some sustained revenue growth for the third quarter.

Also close at hand are retail sales numbers for September which should provide an early indication of the upcoming (and some say already doomed) 'holiday shopping season'. Wal-Mart, for instance has already gone on the offensive by saying it will offer about a hundred toys priced at under $10 (last year, the company offered a mere ten such low-priced toys). One retail expert suggested that it is now almost seen as a 'badge of honor' for consumers not to spend as much as they used to. About 30 retailers will be providing numbers on Thursday; these will allow retail analysts to project sales data into the future and make predictions about the next few months.

Saturday, October 3, 2009

Swing Dynamics On The First Hour

This trade was good for + 4.5 Points

ES Emini trade set ups that anyone can do and follow

Friday, October 2, 2009

Weekly Trendlines And The Trend

Sell Signal In T-Bonds 30yr Futures

The government's much feared 'jobs report' was released today and it brought a dose of bad news. According to the Labor Department, 263,000 jobs were lost in September, far more than the 180,000 job losses economists had been expecting. The US unemployment rate meanwhile swelled to 9.8% (from 9.7% a month earlier). Despite the significant amount of talk in the mainstream press about the end of the recession having arrived, the dynamics of the job market remain quite disturbing and may put the entire recovery scenario into question. Not only is the rate of workers being laid off not abating, the pace at which companies are hiring is also at almost historical lows.

Market commentators point out that even though consumer spending has steadily improved over the past few months, such gains will not be sustainable over the long term in the face of such poor jobs numbers, and also because they are largely based on temporary government incentives (such as the popular Cash for Clunkers program).

Not only are more Americans relying on unemployment contributions than ever before in the post-war era, but they are also staying unemployed for a more extended period of time. For instance, of the total officially unemployed population, the percentage of those who can be classified as 'long term unemployed' has now reached 36% (in contrast, after the recession of the 1980s, that number had peaked at close to 25%).

Finally, among those who are working, another new post-war record has been reached, with the average workweek now down to 33 hours. Meanwhile, over 9 million people are working part-time due to economic reasons; this is also a very high number.

Long from 1013

after the negative reaction to the Unemployment Report:

Thursday, October 1, 2009

Market Timing Strategy BUY Signal